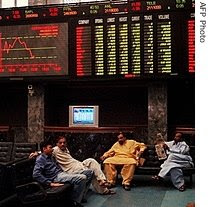

Desperate Times, Desperate Measures for Pakistani Investors

Fearing a complete meltdown of stock prices at Karachi Stock Exchange, Pakistan's Securities and Exchange Commission imposed a floor of 9144 for the market's benchmark KSE-100 index. The index closed at 9144 level on Wednesday, Aug 27, the day the KSE and SEC announced their decision to not allow the KSE-100 to trade below this arbitrary level. This extraordinary action, the first of its kind since the exchange opened its doors in 1948, came after investors pushed down the index to its lowest level in more than two years. Karachi stock exchange saw very thin trading on Friday and the KSE-100 index finally closed at 9,208.26 points, with a meager gain of 4.48 points. The KSE-30 index increased by 15.87 to close at 10,198.05 level. The KSE-100 has lost 34.6% of its value this year, as investor confidence has been been hurt by political uncertainty and a long list of economic troubles, including skyrocketing inflation, disappearing foreign exchange reserves, declining rupee and a